TLDR (too long didn’t read): What you need to know

Business scenario planning helps you test decisions before you commit. By modelling a base case alongside best and worst case versions, you can see the profit and cash impact of each choice and be ready to adapt if conditions change. At Harland, we build scenario planning into cash flow forecasting so founders can make values-led decisions with clarity and confidence.

By Deborah Edwards

Deborah is a Chartered Accountant, Harland Director, entrepreneur, and business transformation expert with over 20 years’ experience.

Thinking three moves ahead

When I was about seven, my grandfather taught me to play chess. The lasting lesson alongside those games, tense with thought, was that he always told me to think three moves ahead and to imagine what might happen if I took a certain move. As I grew older and improved my game, he became less inclined to go easy on me. I learnt that progress depends on seeing not only your own move but also the possible responses. Business scenario planning is no different.

Why business scenario planning matters now

Running a business today means facing rapid change and uncertainty. Costs rise quickly, supply chains are fragile and sales cycles can stretch out longer than expected. Many of our clients are asking themselves questions such as whether to bring in another member of the team, how to adjust pricing without losing customers, or whether to expand (or leave) a site. Each of these decisions carries opportunity and risk. Without a structured way to test them, it is easy to feel paralysed or make choices under pressure.

What scenario planning really is

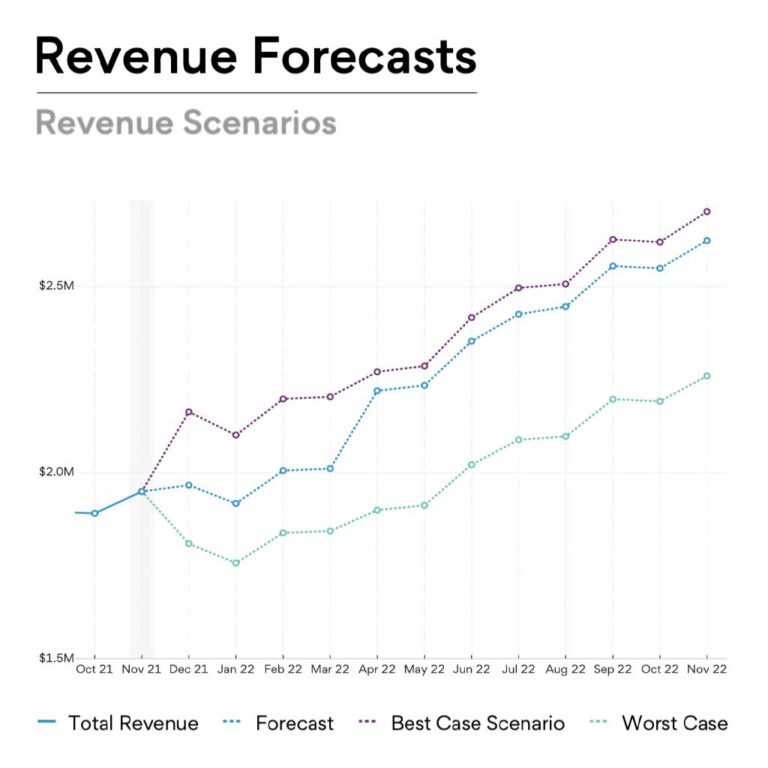

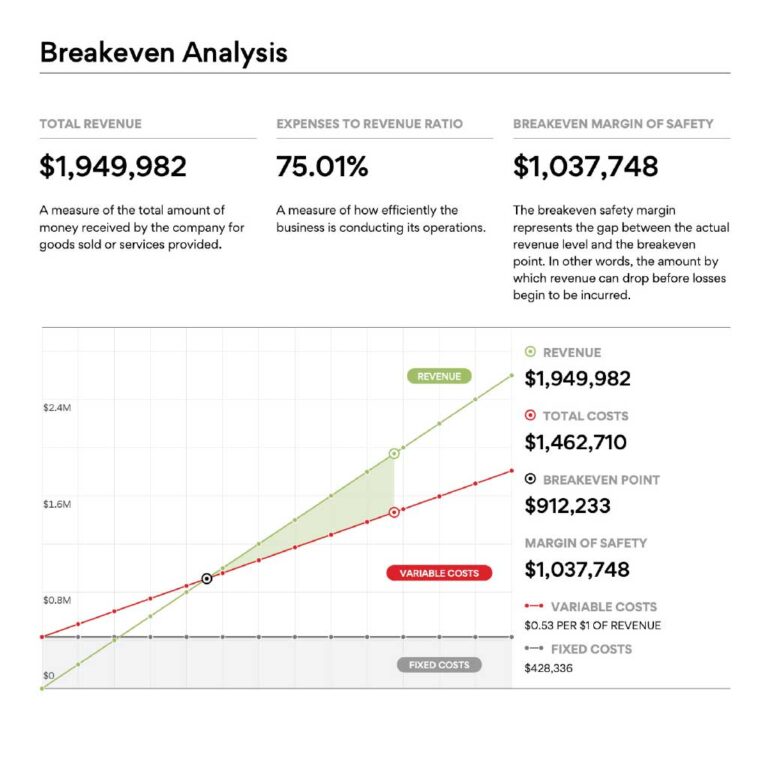

Business scenario planning is structured “what if” thinking. Instead of relying on a single forecast, you create different versions of the future and see how they play out. You might hold a steady base case, imagine the upside if things go better than expected, and test the downside if sales slow or costs rise. Each version runs through a model of profit, balance sheet and cash flow. This allows you to answer the question that matters most: will we have the cash to do what we plan, and if not, what can we change?

The benefits for founders

For founders, business scenario planning brings calm to decision-making. It gives clarity on the levers that shape results such as pricing, volumes, margins, hiring and lead times. Because it sits within cash flow forecasting, the two work together: your forecast shows the week by week cash picture, and scenario planning stress-tests it so you are not caught off guard. This approach also allows you to put values into practice. If you want to pay the real Living Wage or choose lower-carbon suppliers, you can see exactly what those choices mean for cash and build them in responsibly.

How it works in practice

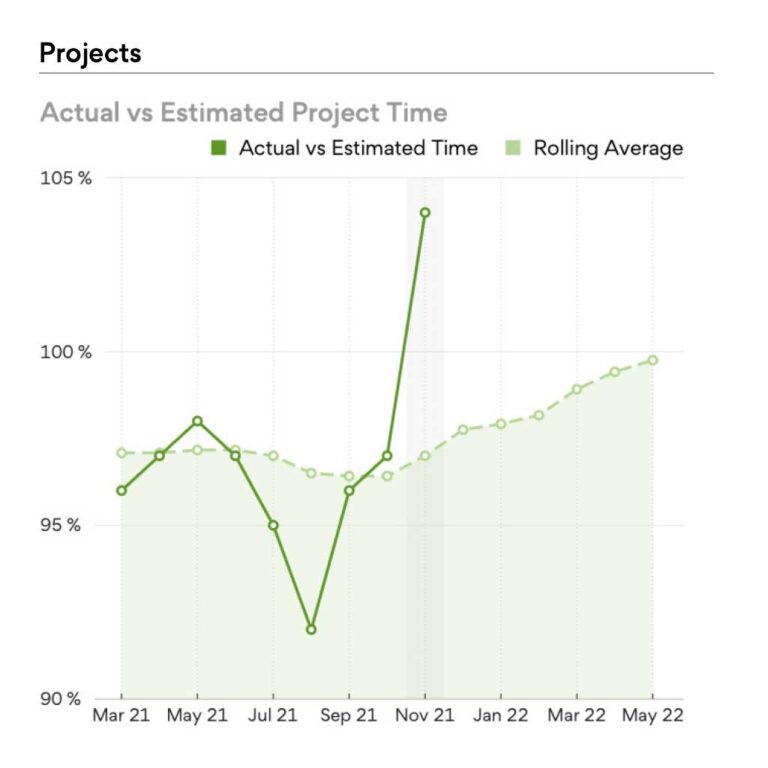

The process begins by clarifying the decisions you expect to make in the coming months and the values you want to protect. From there, we map the key drivers such as sales volumes, average order value, utilisation, supplier terms and how quickly it takes for the money to come in. We set a realistic base case, create an upside and a downside version, and then test how each flows through profit, balance sheet and cash. We also agree clear triggers so that if one of the warning signs shows up, you already know the action you will take.

A simple example

Imagine you run a growing e-commerce brand. You are considering a three percent price rise in June and a temporary pop-up in the run up to Christmas. The base case assumes no price rise and one additional warehouse hire in August. The upside assumes the price change goes through with minimal volume impact and stronger footfall in the pop-up. The downside assumes slower sell-through and a courier surcharge.

Run through the forecast, the upside funds the pop-up comfortably. The base case works if supplier terms extend slightly. The downside reveals a September cash dip unless the hire is delayed or marketing spend is shifted to higher return channels. What felt uncertain suddenly becomes a set of clear, values-led choices.

Why this matters for Harland clients

At Harland, we work with founders and business owners who want to grow without losing sight of their values. Business scenario planning makes that possible. It brings structure to difficult decisions, prevents last-minute stress and helps you keep your business resilient. Above all, it gives you the confidence to pursue growth knowing that you have tested the numbers and prepared for what might happen.

How to take the next step

If you want to explore this further, start with our cash flow forecasting service. We will build a clear forward view, add robust scenarios and agree practical triggers so that you and your team know what to do and when.