For many businesses, traditional goal-setting revolves around sales targets, market expansion, and operational efficiency. But the Profit First method challenges this norm and places profit at the forefront of your financial strategy, flipping the script on how you allocate your financial resources to achieve an end result that is both rewarding and sustainable.

What is the Profit First method?

The Profit First method is a cashflow management system that makes business profitability a non-negotiable priority and redefines success by the actual money your business keeps, rather than the sales it generates. It ensures businesses set aside profits from sales immediately and, when combined with a conscious approach to profit allocation, ensures everything you care about is adequately catered for. No longer is profit just a happy accident – it is a well planned and strategic outcome.

How to apply the Profit First method

Profit First is based on a simple formula: Sales – Profit = Expenses

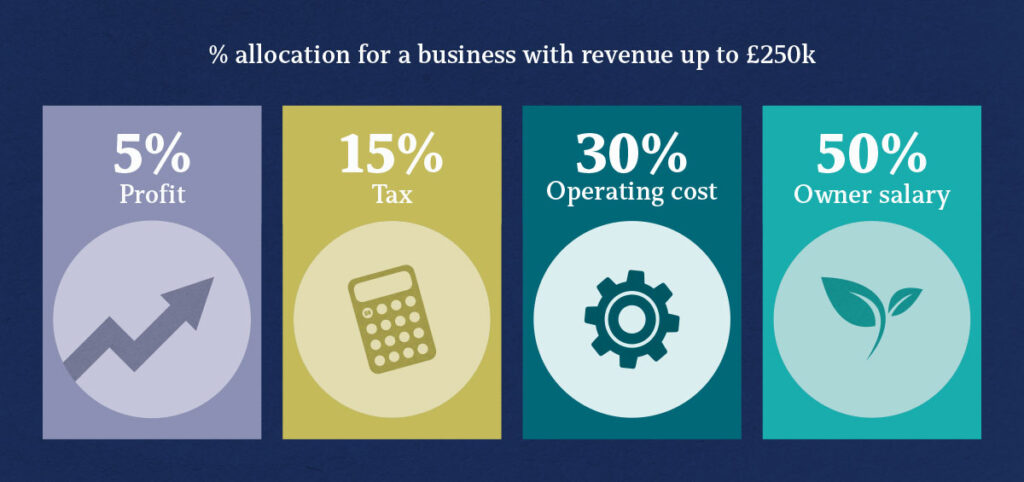

The Profit First method is like paying yourself first when you earn money. So, whenever a sales deposit lands in your bank account, a specific portion is set aside as profit before any expenses are deducted. To do this, you need to determine exactly how much profit you’d like to make (the table below gives a rough indication of the percentages you could aim for). Instead of waiting to see what’s left after spending, you decide on a portion to save as profit (e.g. 5%) before paying any bills, which helps ensure you always set aside money for profit, making your business more financially stable.

Profit First in 3 simple steps

- Allocate funds – Decide on a percentage of each sale to allocate as profit (e.g. 5%). Separate this into different bank accounts (one for profit, one for taxes, one for expenses, and one for owner’s pay).

- Prioritise profit – Every time money comes in, transfer the designated profit percentage directly into the profit account. This ensures profit is set aside before other expenses.

- Monitor and adjust – Regularly review your accounts. If expenses exceed what’s in the expense account, it’s a sign to adjust spending. Always prioritise profit allocations.

Conclusion

The Profit First philosophy is more than a financial budgeting strategy – it’s a holistic mindset that reshapes the way you view success. It safeguards the financial health of your business and creates a solid foundation on which to reinvest in your business’ growth and enjoy all the things that are important to you.

Remember, profit isn’t just a one-time thing; it’s about cultivating a consistent habit. So, let’s embark on this journey together and redefine your goals with a focus on sustainable profitability.

If you’d like to adopt the Profit First method in your business, talk to your Client Manager today. As your dedicated accountant, we’re here to guide you through this transformative process, and help you navigate the nuances and implement Profit First seamlessly.