Currently, businesses can set their own accounting period and their year end based on a date in the tax year that suits individual needs. But from 6 April 2024, this is changing …

What is changing?

The time period sole traders and partnerships use to calculate their taxable profits is being reformed by HMRC. This is because they want everyone to have a unified accounting period that aligns with the standard UK tax year, set as 6 April 2024 to 5 April 2025.

Basis period vs accounting period

The accounting period and the basis period are often the same, but up until now businesses have been able to decide if this suits their needs and change it accordingly. But from April 2024, this will no longer be possible.

The accounting period (or accounting year) can currently be chosen by the business based on individual needs. For example, a business that is very seasonal, such as farming, may choose to have an accounting period year end of 31 October as this coincides with the end of harvesting. Or a business set-up in the middle of a tax year, may choose to have that date as the start of their accounting period.

The basis period, however, is the window of time HMRC uses to calculate income tax liability, which they now want to be standardised, so legislation is changing and from April 2024 all businesses will need to use the standard UK tax year (6 April 2024 to 5 April 2025).

Who does this impact?

This change only impacts unincorporated businesses, essentially self-employed sole traders or partnerships, who don’t use the standard year end or either 31 March or 5 April.

What are the changes and how does this impact me?

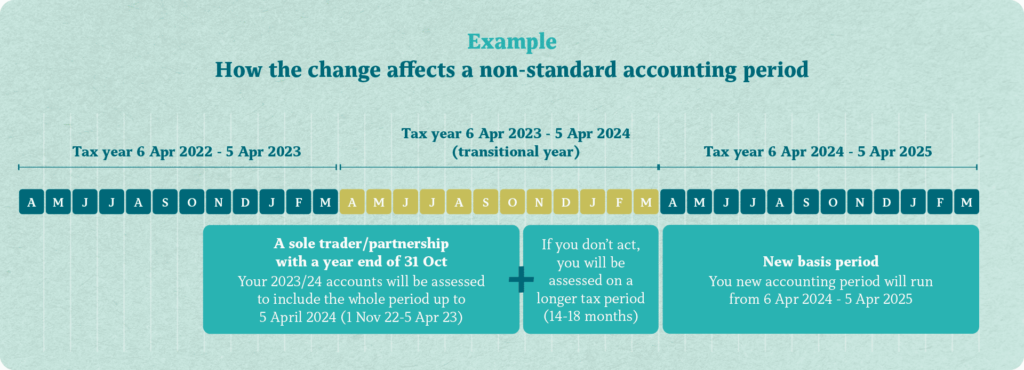

The current 2023/24 tax year is the transitional year, and impacted sole traders and partnerships will now have their accounting period assessed to include the whole period up until 5 April 2024.

For example, a client with an accounting period year end of 31 October 2023 will now have to submit accounts for their usual accounting period plus estimated/completed accounts to take them up until 5 April 2024.

What happens if I do nothing?

Clients who didn’t change their year end will be assessed on a much longer tax period of 14-18 months, which may negatively impact cash flow and even affect child tax benefits.

Next steps

By acting now and changing your year end you could potentially limit an unexpectedly large tax bill. We want to make sure your business is prepared for this change, and our team are on hand to make this transition as pain-free as possible.

If you think this change affects your business, get in touch and we can arrange everything for you.

About the author

Matt Teague

Matt is an ACA Chartered Accountant, Client Manager, and has been practising since 2015. He is Harland’s Compliance Champion.